Image by Freepik

Recession-Proof: Staying Sharp When the Bottom Drops Out by Ian Garza

When the economy tanks, the air changes. People move differently. You feel it in the supermarket aisle, where heads tilt at price tags like they’re trying to solve a riddle in a foreign language. Maybe you’re there, pen hovering over a notebook, drafting your next pitch while wondering if peanut butter can be considered a luxury item now. Recessions have a way of pushing people into the deep end, but oddly, that’s where the best swimmers emerge. The trick is less about bracing for impact and more about learning to glide with the current. Here are seven ways to make the chaos work for you, journal in hand and mind on fire.

Cut Costs, Not Corners

You don’t need to become a coupon-clipping caricature to start slicing your expenses with surgical precision. Start by conducting a cold, heartless audit of your monthly costs—subscriptions, takeout, half-used gym memberships—and ask yourself which of them you’d defend in a court of law. Reallocate the scraps toward things that either earn money or preserve your sanity. Groceries, for instance, offer massive wiggle room if you’re smart about what hits the cart—save money on groceries by swapping brand loyalty for nutritional label scrutiny. Don’t eat out of boredom or habit, eat with purpose. A recession isn’t a punishment; it’s a new set of rules, and frugality is a game you can win.

Skill Up or Ship Out

Those who thrive during downturns don’t wait for job boards to dictate their worth. If your industry’s shaking like a leaf, shift your gaze toward sectors that don’t flinch when markets do—healthcare, IT, education, logistics. There’s a buffet of free online courses that can turn idle time into economic leverage. Learn Excel if you’re breathing. Pick up copywriting, coding, or UX design between episodes of that comfort show you’ve already seen four times. Skills are portable power, and adding new ones doesn’t just insulate your income—it inflates your confidence. The job may not be instant, but the momentum is.

The Side Hustle Shuffle

You don’t need to start a Shopify store selling ornamental cacti to qualify as an entrepreneur, but having a second income stream isn’t a luxury anymore—it’s a survival tactic. Whether it’s reselling thrifted clothes or offering dog walking in your neighborhood, a side hustle doesn’t have to be revolutionary. It just has to work. Take an honest inventory of what you’re good at and find the angle—start a side hustle that fits into your existing life, not the other way around. It might start small, maybe laughably so, but consistency snowballs. One gig turns into a rhythm, and suddenly, your “just in case” income becomes your “thank God I did” lifeline.

Write It Out

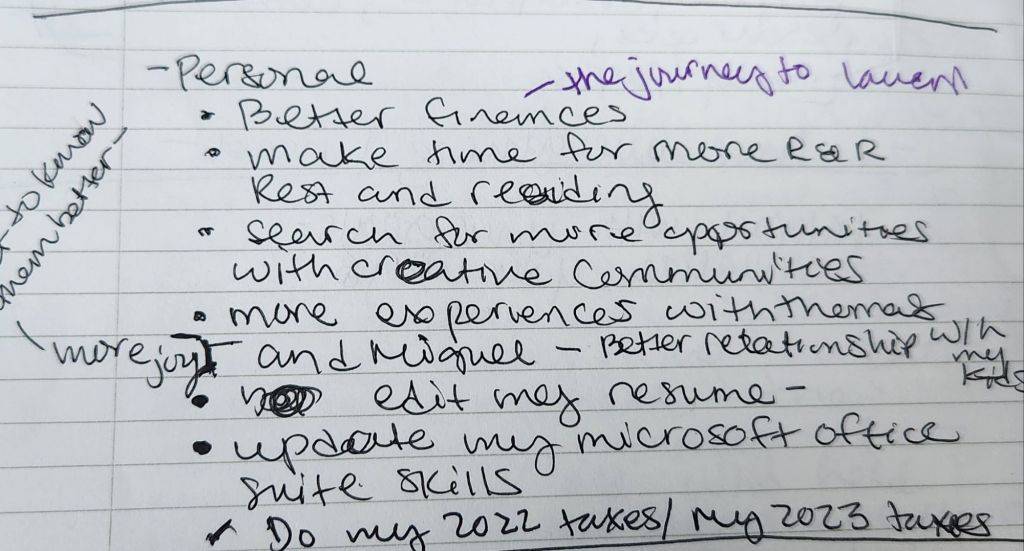

There’s something quietly defiant about writing things down when the world feels untethered. Journaling isn’t about profound revelations or poetic flair—it’s about evidence. Document your spending, your mood, your micro-victories. Create a log of sanity that future-you will be grateful for. The benefits of journaling during tough economic spells are both psychological and strategic—it can help you track your patterns, spot opportunities, and process fear without letting it drive. For writers, it’s a gym session. For everyone else, it’s cheap therapy that never talks back.

Invest in a Home Warranty

Nothing torpedoes a fragile budget like a busted HVAC or a rogue refrigerator. When repair costs punch a surprise hole in your wallet, having a home warranty isn’t just smart—it’s protective armor. These plans can cover major systems and appliances, offering a reliable safety net when unexpected breakdowns hit. The key is picking coverage that doesn’t just slap a Band-Aid on the issue. Find one that includes the removal of defective units and protects against breakdowns caused by botched repairs or sloppy installs—this page is a good resource for comparing that kind of nuanced coverage. You’re not betting on things going wrong. You’re admitting they will, and preparing accordingly.

Community Over Chaos

Isolation is expensive, both emotionally and practically. Reaching out to neighbors, local groups, or church networks isn’t just good manners—it’s fiscal strategy. There’s a staggering array of local community resources offering everything from food distribution to financial counseling, yet many go untapped. It’s not charity. It’s infrastructure—one that exists precisely for this kind of moment. Volunteering also doubles as networking. You help others while subtly reinforcing your own safety net, a win-win most spreadsheets can’t quantify.

Mind Over Money

Financial fear corrodes slowly, eating away at confidence and sleep and even relationships. Address it like you would any other health issue—diagnose, manage, treat. Don’t ignore your stress or trivialize it. And don’t obsessively refresh stock tickers or headline feeds. Use breathing techniques, therapy apps, and if needed, professional help. Learn how to manage financial stress in a way that doesn’t involve locking yourself in a doomscroll loop until 2 a.m. The money part is real. The mental toll is realer. You need both ends intact if you’re going to make it through with anything resembling grace.

There’s no single blueprint for surviving a recession because recessions don’t care about blueprints. They bulldoze predictability and force reinvention. But they also burn away distractions and push people toward clarity. Whether you’re writing it out, hustling at night, or just trying to keep your fridge running without inviting financial ruin, the throughline remains the same: adapt with intention. You don’t have to thrive every day. You just need to keep moving—and that, on the worst days, is a kind of success all its own.

Discover the transformative power of poetry and personal storytelling at Life on the BPD, where creativity blooms and every verse is a step towards healing and empowerment.